In the age of selfies and social media, appearances matter. It’s not just a question of looking good but also about feeling confident in ourselves as we go about our everyday lives. What we wear and how we look are factored into decisions we make on a daily basis. But how do these decisions differ across Asia Pacific? Research firm YouGov polled 12,240 netizens in APAC between 14 October and 20 October 2016 to uncover beautifying behaviors across the region.

Cosmetics are key to many people’s beauty regime, but how regularly they are used varies significantly across APAC. Thais and Indonesians use cosmetics most often, with over half of Thai women (53%) and Indonesian women (52%) using cosmetics everyday, well above the regional average of 38%. By contrast, women in Australia (27%), Singapore (27%) and Hong Kong (28%) are least likely to use cosmetics everyday. Fewer than one in five women (18%) never use cosmetics, suggesting cosmetics play an important role in many beauty regimes across the region.

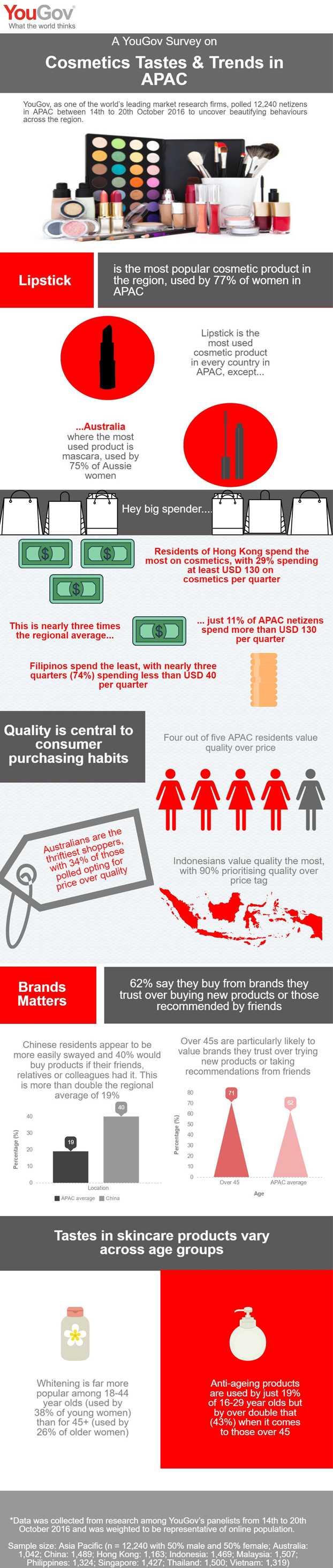

The popularity of products is far from universal. While mascara is the most popular product in Australia with three out of four Aussie women using it, it’s used by less than half (45%) of women across the region.

However, the popularity of lipstick transcends borders in Asia. It is used by over three-quarters of women (77%) in APAC. It is also the most used product in all APAC countries except Australia.

Lipstick is not just popular but also highly-prized. When asked to pick just two cosmetic products to use, lipstick (52%) and liquid foundation (28%) are seen as the most indispensable among women polled in APAC.

Looking good also comes at a price. But just how much are people happy to pay? Residents of Hong Kong spend the most on cosmetics per quarter, with 29% spending at least USD130 on cosmetic per quarter. This is nearly three times the regional average, with just 11% of APAC netizens spending more than USD130 per quarter. Filipinos spend the least, with nearly three quarters (74%) spending less than USD40 per quarter.

Despite other differences, four out of five APAC residents are united in valuing quality over price. Australians are the thriftiest shoppers, with 34% of those polled opting for price over quality. Indonesians value quality the most, with 90% prioritizing quality over price tag.

Consumer habits in cosmetics appear to be well-entrenched, with the majority (62%) of those polled saying that they buy from brands they trust over buying new products or those recommended by friends. This also increases with age, with 71% of those over 45 only buying from brands that they trust. However, 40% of Chinese residents appear to be more easily swayed and would buy products if their friends, relatives or colleagues had it. This is more than double the regional average of 19%.

Skincare stands alongside many beauty regimes as an important part of maintaining a healthy complexion. Tastes converge when it comes to recognizing the importance of hydrated skin; moisturizer is the most commonly used skincare product across the Asia Pacific, with 69% of those polled using it regularly.

Yet popularity of skincare products varies significantly across age groups. It should hardly come as a surprise to learn that the generational divide is starkest in use of anti-aging products, used by just 19% of 16-29 year old women but by over double that (43%) when it comes to women over 45. By contrast, whitening is more popular for 18-44 year old women (38%) than for women aged 45+ (26%).